Budget Island

The Journey Begins!

The most crucial island lies ahead. Take your time as you traverse its terrain, observing every detail with care. Document your findings on parchment with precision and thoroughness. What you record here will serve as a vital guide to steer us through the rest of our voyage.

Tracking Your Expenses

I can’t stress enough how critically important this is to the rest of our journey. We must commit to applying what we learn on this island!

Most people know what a budget is, it’s a financial plan where you allocate your income to your expenses and hopefully have some left over for savings.

Unfortunately, we have come equipped with a primitive brain that doesn’t always commit itself to the most logical solutions, otherwise you wouldn’t need ‘your treasure compass’. We have emotions and wants that are not always rigid and logical in nature. In fact, if we were to really boil things down, the only things you need are food, water and shelter. Screw that, we want more! We want more for ourselves and for our family. Without that drive for survival AND to thrive our family tree would have shriveled up and died generations ago.

If we think about budgeting, we all groan and roll our eyes because we know that means depriving ourselves of immediate satisfaction of our wants. If we could do that we wouldn’t be in this mess!

So, to begin with we’re going to approach things a bit differently on this Island. It’ll still be difficult and will require a commitment from you. If you stop at this hurdle then you are free to take your battered and leaky ship back to port and let it rot out until she sinks to the bottom of the harbour. For the rest of you, it’s time to form a new habit that will be a major step towards getting us afloat and onto the next leg of the journey.

We’re not going to restrict ourselves here on this Island, we’re going to do exactly what we normally do but with one key difference. We’re going to TRACK IT! Perhaps it should be called “Expense Tracking Island instead but we have our own rules out here

Enjoy the fruits of this island, sun yourself relax and take in the sights. But I want you to record EVERYTHING. With the metaphor that I am beating to death right now I am saying that I want you to record every single cent that goes out, whether it be cash, credit card, bank transfer, whatever. You need to physically track it on a spreadsheet or in a physical journal. These days there are apps and software programs you can use that would make this easier, but I don’t want you to use them.

You need to form a habit EVERY SINGLE DAY of physically recording your spending. It needs to be a pain in the backside. The more annoying it is for you, the better.

Every time you or your spouse spends money or money comes in, I want it recorded. If you miss a day you MUST CATCH UP THE NEXT DAY and you must not miss even 1 solitary cent. You need to commit to this for 30 days and I’m not going to sugar coat this, if you have the stones to do this right, you will be doing it forever. I have been doing it every day for 15 years now. It was an absolute pain for a long time but now it is an integral part of my life. It is more annoying NOT to do it than it is TO do it.

So, did I restrict my spending? NO, I merely tracked it. The funny part about it, is that by tracking it, your relationship with money will change and budgeting will become an incidental side effect of the tracking itself. This is critical. Tracking spending will not automatically make you rich, but it’s the absolute foundation to getting your finances under control and strengthening your self-discipline in the process. Our spreadsheet is going to look very boring to start with, but our goal is to start basic and to make tiny incremental improvements every day.

To begin with we will feel like our ship is hardly moving. There’ll be very little wind in our sails and we will be disheartened. Well, toughen up princess because sooner or later you’ll notice that we’re actually moving bit by bit, almost unperceptively faster than the day before. This is no speedboat where you hit the throttle and zoom across the bay with an obnoxious buzz and a trail of smoke in mere minutes! This is a majestic sailing ship that takes work and courage and changing course is a matter of degrees and patience!

Alright, let’s get to the nuts and bolts of the process. You can use Microsoft excel which you pay for, or google sheets which is free. It doesn’t matter; they are both suitable for what we need. If you are less interested in using technology a good old pencil and paper will do just as well.

If you’re not familiar with how to use these programs, don’t worry we only need the extremely basic functions of them right now. Later on, you might find it fun to start using the data to make charts and add colours and all sorts of geeky calculations and other nerd stuff, but don’t worry about that right now.

Step one is to categorize our spending

Everyone’s spending habits (and I use that term deliberately) are different so you can have a think about the best way to do this that suits your situation best. Try to keep the number of categories low enough so that they’re easy to find but high enough to be able to use the data in a useful way later. Taken to the extreme for example only having two categories “income” and “expenses” tells you almost nothing whereas having 500 categories including specific items of clothing or specific types of entertainment costs just makes it an absolute chore and again, becomes meaningless.

The must have category is “Miscellaneous” because there will be times where one-off weird expenses just don’t fit anywhere. If they become a regular expense then simply add a category.

Click on the link to download either an excel template or a google sheets template to use to track your expenses or prepare a balance sheet

Expense Categories

- Food shopping

- Mortgage /rent payments

- Childcare costs

- Diesel for car one

- Petrol for car 2

- Mobile phones

- Landline/internet

- Camping/holiday costs

- Pet costs

- Alcohol

- Kids extra-curricular activities

- Car registration car 1

- Car registration Car 2

- Allowance (more on these “allowances later)

- Fast food

- House/Garden/Cars

- Clothes

- Entertainment

- Gifts for us

- Gifts/postage for others

- Doctor/medical/teeth

- Family health insurance

- Bank charges

- Children costs

- Council Rates

- Water Rates

- Electricity

- Buckets (this is later down the track so ignore for now)

- Dog registration

- Fuel for jerry cans (for lawnmower etc)

- House and car insurances

- Donations

- School costs

- OTHER (miscellaneous)

You will salt this to taste of course. If you like to race cars on the weekend or have a dozen loans to service then it might look a bit different. If you have a dozen loans by the way, then we will be dealing with that at Debt & Danger Rocks

Here are some other categories you might consider

- Retirement contributions

- Dining out

- Subscriptions (more on those evils later)

- Hobbies

- Personal Care (Haircuts, Beauty Products)

- Cleaning Supplies

- Home Repairs

- Appliance Maintenance

- Gardening Supplies

- Laundry Expenses (Dry Cleaning)

- Gym Memberships

- Tech Upgrades (Phone, Laptop)

- Professional Development (Courses, Certifications)

Income Categories

For income there could be

- Investment income

- Salary/wages

- Business income

- Rental property

And of course there are a million more possibilities. You’re not stupid so I trust you to work out the categories that best suit your situation. Just know that the more categories the more time it will take to record.

Other income sources can be

- Freelance income

- Dividends

- Interest

- Pension

- Unemployment benefits

- Child support payments

- Tax refunds

- Side hustles

- Selling goods (eg. Garage sales)

- Gifts (wndfalls)

- Bonus or commission

And again, you should include an “OTHER” or “Miscellaneous” category.

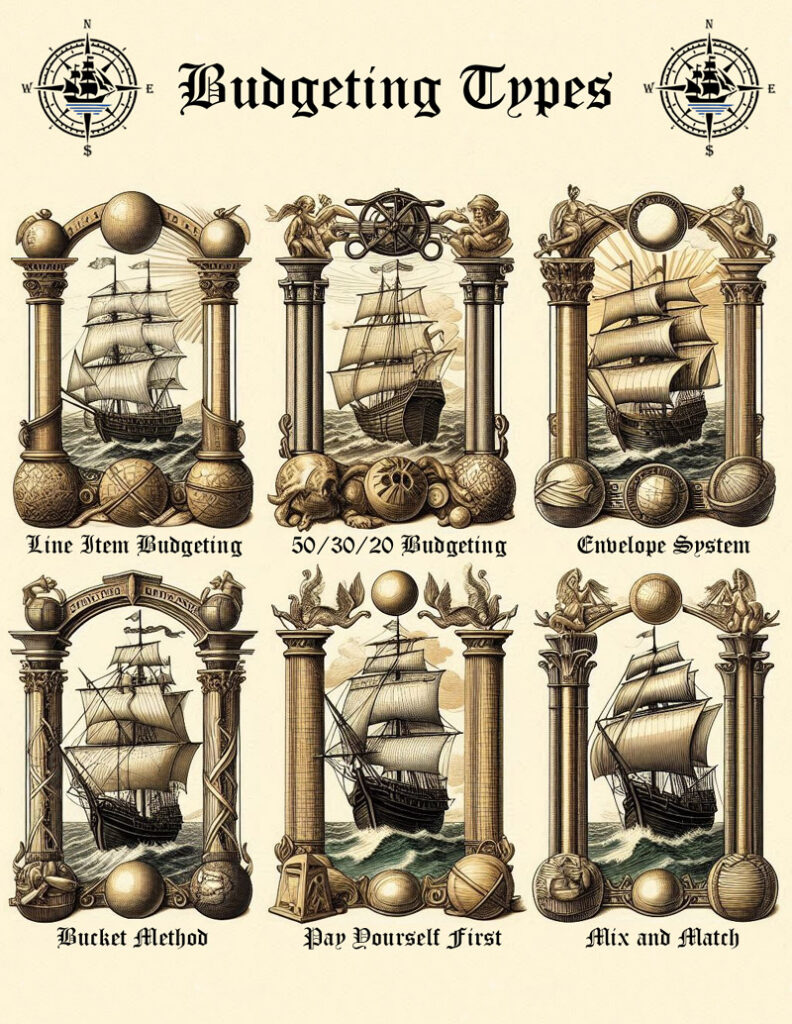

Budgeting Types

Once you have tracked your expenses for a while, you will get a very good idea of where your money is going. You can then use this information as leverage to refine your processes. You can easily see for example where your biggest expenses are and what you could cut back on or make more efficient. You can also decide if you want to use your system as a purely tracking method or use it to allocate spending and income in a more purposeful manner. There are several methods for doing this and you can experiment to see which one works best for your personality and situation. This simple action has the potential to by life-changing.

1. Line-item budgeting

The line-item system of budgeting involves breaking down your finances into specific categories and assigning a precise dollar amount to each. For example, you might allocate funds to rent, groceries, transportation, entertainment, and savings as distinct “line items.” This method offers a detailed and structured approach, making it easier to track spending, identify areas for adjustment, and stay aligned with your financial goals. Those of you paying attention will see that this is the tracking method that we have chosen as the base for your treasure compass.

ADVANTAGES:

- Extremely detailed, allowing precise tracking of income and expenses.

- Helps identify overspending in specific categories for better adjustments.

- Suitable for individuals who prefer meticulous financial planning

DISADVANTAGES:

- Time-consuming to set up and maintain.

- Can be overwhelming for individuals who are new to budgeting or prefer simplicity.

If you prefer simplicity then you can download apps that will take the actual work out of this process but we’re after a psychological shift to how we deal with money. Simplicity in the way we spend has gotten us into this mess in the first place, so we’re not looking for a band-aid solution here. Our finances require scrutiny and an investment in time and energy. However, there is no such thing as wasted work. Even if it doesn’t benefit you immediately, somewhere at some point you will reap the rewards of hard work. Sometimes in the most unexpected ways.

2. 50/30/20 Budgeting

The 50/30/20 budgeting rule is a simple guideline for managing your income. It suggests allocating 50% of your after-tax income to necessities like housing, utilities, and groceries, 30% to discretionary spending such as entertainment or hobbies, and 20% to financial goals like savings, investments, or paying off debt.

ADVANTAGES:

- Simple and easy to follow, with clear percentage allocations.

- Offers flexibility, especially for wants and savings

- Encourages balanced financial management by addressing needs, wants, and savings

DISADVANTAGES:

If you have high debt levels or high costs then this method leaves a lot to be desired. You may have to be a bit more ruthless to get out of debt.

- Variations in income and expenses can make this method difficult to maintain

This method is overly simplified and I have found it to be more of a gimmick than a useful method. Having said that, if you think it might work for you, then try it. You may even wish to change the percentage allocations to suit you better. You can always change to a different method later if it doesn’t!

3. The Envelope System

The cash envelope system is a simple budgeting method where you allocate physical cash into labeled envelopes for specific spending categories (e.g., groceries, entertainment, transportation). Once an envelope is empty, you can’t spend more in that category until the next budgeting cycle, helping you stay within your means. It encourages mindful spending and makes it easier to track expenses, as you can visually see how much money is left for each category.

ADVANTAGES:

- Highly visual and tangible, making it easy to monitor spending.

- Helps prevent overspending and reinforces discipline by limiting access to funds.

- Ideal for users who prefer cash-based systems and physical tracking.

DISADVANTAGES:

- Inconvenient for online purchases or users who rely on electronic payments.

- Carrying cash in envelopes might pose safety risks.

- Tracking envelopes for numerous categories can become cumbersome.

This method works for some people but unfortunately as a society we are moving away from physical cash which makes this method less attractive than it once was.

We can use a modified envelope system better suited to the digital world in which we live, called the “bucket method”

4. The Bucket Method

Similar to the envelope method but instead of physical cash in an envelope we use a number of possible digital equivalents. If you have good willpower and organisational skills then you can create virtual envelopes on a spreadsheet and you would treat them exactly as you would a physical wad of cash. You would split your income into the various headings of your spreadsheet. You would have a column in and a column out and split your income into the buckets and remove from them as you spend.

Alternatively, you can set up sub accounts directly in your bank account if your bank provides such an option and you can split the money between those accounts. You can set up different accounts within the same bank or across different banks if you prefer.

ADVANTAGES:

Convenience: A spreadsheet allows you to easily update and track your budget anywhere, without handling physical cash or envelopes.

- Flexibility: You can adjust categories, amounts, or add new line items without needing to reorganize physical envelopes.

- Accessibility: Digital spreadsheets can be shared, backed up, or accessed across devices, ensuring you never lose track of your budget.

- Automation: You can incorporate formulas, charts, or even link your spreadsheet to financial data for automated tracking

DISADVANTAGES:

- Reduced Tangibility: Seeing and handling physical cash gives a clearer sense of how much is being spent or saved; this psychological aspect is lost digitally.

- Discipline Challenge: Without the physical barrier of empty envelopes, it might be easier to overspend or shift funds between categories.

- Technical Skill: Creating an effective spreadsheet might require familiarity with software like Excel or Google Sheets.

- Overlooking Small Details: Some people find they’re less mindful of small transactions when using a digital system versus cash.

Dependence on Devices: Requires access to a device and potentially internet connectivity, which might be inconvenient for some.

As long as you are meticulous with your record keeping this is a great method and one I use all the time. It also gives you a little flexibility as you can move buckets around should the need arise. Life (like our ship) doesn’t always move in a straight line

5. Pay Yourself First

Prioritizing saving or investing a portion of your income before addressing other expenses. As soon as you receive your paycheck, you set aside money for savings, retirement accounts, or other financial goals, treating these contributions like essential expenses. This approach helps build wealth over time and ensures that savings take precedence over discretionary spending.

ADVANTAGES:

Prioritizes savings and investments, fostering wealth-building habits.

- Encourages individuals to set financial goals and meet them.

Reduces the temptation to overspend before saving.

DISADVANTAGES:

Requires careful budgeting for remaining expenses

May Overlook Expenses: If savings are prioritized too aggressively, it might leave insufficient funds for essential bills or unexpected costs.

- Less Flexibility: Allocating a fixed amount to savings each cycle may not account for fluctuating income or expenses

Hard to Implement: For those with tight budgets, finding money to set aside might feel challenging or stressful.

Requires Strong Tracking: To avoid falling behind on other obligations, close monitoring of remaining funds is essential.

This is a great method as long as you remain diciplined with your tracking of income and expenses. It also depends where you are at this pooint in time. If you are heavily indebted then getting the debt to a manageable level first is key. We can’t begin to build wealth if debt is constantly pulling us backwards.

6.. Mix & Match

We’re already going the line-item budgeting route here using your treasure compass but there is no reason you can’t incorporate elements from other budgeting methods listed. Once you’ve got in the habit of recording your transactions you may like to create a separate tab on your spreadsheet and create a list of buckets and transferring those amounts to and from your tracking spreadsheet. Or perhaps you will take what is left over at the end of the month and allocate that to a savings bucket. Perhaps you will give every dollar a purpose with hopefully savings, investing or paying down debt being one of them.

After trying all the different methods I have found a combination of tracking my spending and paying myself first have been the most powerful. For example, at the same time each month (pay day) I will put a fixed amount of my pay into a savings bucket and a fixed amount into investments. Then I will put a fixed amount into a health insurance bucket so that when the big bill rolls around each year, I can draw from that. After that I just track my expenses and income as usual. By the next pay day, I will see if I am ahead. If I am then I put the surplus into other buckets such as for a family holiday or whatever. I will also fund my emergency fund bucket. If I am behind for the month then I will have to draw from somewhere to zero out for the month. I may have to take out from my emergency fund bucket or savings bucket. The goal is to be in the positive each month. It’s not always the case but the ultimate goal is to spend less than you earn through the year. As long as you are ahead more than you are behind then you are winning!