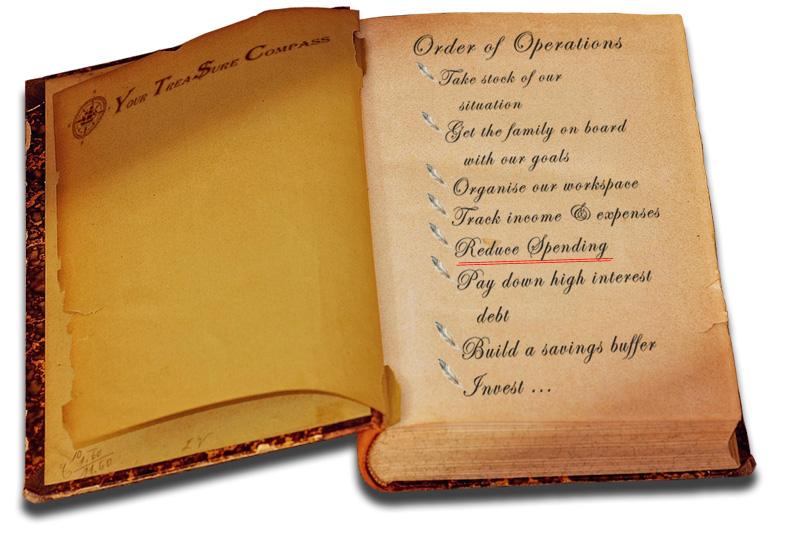

Watch the Doubloons

Spend Smarter

Make a budget and stick to it — track every dollar. (Visit Budget Island for more).

Use a shopping list to avoid impulse buys.

Buy generic brands — often just as good as name brands.

Wait 24–48 hours before making non-essential purchases.

Back on board the ship

At Home

Cook at home instead of eating out — meal prep can save a lot.

Cut subscriptions you don’t use (streaming, apps, magazines).

Use energy-efficient appliances and turn off lights when not needed.

DIY repairs when possible — YouTube is your friend!

Look into technologies such as solar, batteries or home insulation